Directors are responsible for overseeing our business strategy and objectives consistently with their fiduciary duties to shareholders. The Board believes that each director and nominee for director has unique and valuable individual skills and experience that, when taken as a whole, promote the overall management of the Company for the benefit of our shareholders. Moreover, the individual qualifications, accomplishments and characteristics of each of our directors and nominees for directors provide us with the variety and depth of knowledge, diversity, judgment and vision necessary to provide effective oversight in guiding our affairs and direction.

We believe that each director and nominee for director has qualified experience in a variety of fields, including services delivery, industry, transportation, governmental, regulatory, nonprofit, education, and environmental protection, each of which we believe provides valuable knowledge and insight concerning various elements of our business.

All directors play an active role in overseeing our business, both at the Board and Committee level. The directors and nominees for directors have demonstrated leadership skills in managing business risk and in various aspects of business, government, education and philanthropy, which contributes significantly to fulfilling their responsibility to us and to our shareholders.

In addition to the biographical information presented above for each director, the following outlines additional experience and qualifications of our directors that we believe makes each person uniquely qualified to serve on our Board of Directors at this time.

Individual Qualifications

Mr. Ginn

Extensive experience in environmental conservation, most notably in sustainability, recycling and forest conservation

Undergraduate and graduate work in human ecology and landscape architecture

Well-versed in the various aspects of starting, managing, and selling a successful recycling business

Executive-level management experience

Mr. Hall

Extensive experience in business leadership, financial management and financial audit

Well-versed and experienced in environmental policy

Significant involvement in human resource and corporate management

Experienced in mergers and acquisitions and strategic planning

Mr. Warfel

Over forty-years executive experience in sales, marketing, and growing companies, including significant experience with acquisitions and their "integration"

Extensive and significant experience in property and casualty insurance, as well as risk management

Business owner, including current ownership of consulting entities, with expertise in succession planning and leadership transitions in small and large companies

Financial acumen and experienced with Employee Stock Ownership Plans ("ESOP")

Mr. Covey

Twenty-four years of experience in the Company with involvement in all U.S. operations and various administrative groups

Board member experience with nonprofit and professional organizations

Financial auditing experience with a large national accounting firm and the Company

Extensive involvement in all aspects of mergers, acquisitions and strategic partnerships

Mr. Cunningham

Executive-level experience with a service-based over-the-road transportation public company

Chief financial officer with responsibility for internal and external financial reporting, including filings with the SEC

Executive-level responsibility for corporate-wide human resources, including compensation, benefits, and policy

Fifteen years of experience as a CPA with a large international accounting firm and experienced in mergers and acquisitions

Ms. Harbrecht

Extensive experience in business marketing, advertising, promotion, public relations and communications

Experienced as an educator guiding and facilitating student learning

Significant involvement in college advisory boards and councils

Over twenty-five years of executive-level experience

Mr. Brown

Twenty-five years of executive experience with transportation companies involved in freight and parcel delivery services

Extensive experience with internal and external financial reporting, including filings with the SEC and interactions with audit committees

Thirteen years of experience as a CPA with a large international accounting firm concentrating on financial audit services and acquisitions

Executive level responsibility for risk management and human resources

Mr. Warnke

Forty-two year career in the horticulture, arboriculture, landscape and environmental science industry

Board member for multiple nonprofit and professional organizations for over twenty years

Extensive experience in business management, strategic plan development, sales, production, and management of multiple services and subsidiary companies in the United States and Canada

Twenty-seven years of executive-level leadership in the Davey Company and subsidiaries. Also serves as a director for a multinational employee-owned ink manufacturing company

CORPORATE GOVERNANCE

Director Selection Process

We believe the Board should represent a broad and diversifieddiverse spectrum of experienced and qualified individuals who are able to contribute value to our success.business. The Nominating and Corporate Governance Committee is responsible for the review of and recommendation to the Board of Directors of nominees for election as directors. The Committee works with the full Board to develop criteria for open Board positions, taking into account the factors that it deems appropriate. These factors may include identifying a nominee whose array and diversity of talents, experiences, qualifications, personal attributes, and skills would complement those already represented on the Board; the level of independence from us; our current needs, business priorities, objectives and goals; and the need for a certain specialized expertise. In applying these criteria, the Committee considers a candidate's general understanding of elements relevant to the success of a service company in the current business environment, the understanding of our business and our risk factors, senior operating experience with a service company, public company, or other organizations, and a broad understanding of and direct experience in corporate business and service delivery, as well as the candidate's educational and professional background. The Board believes that diversity of professional experience, professional training and personal accomplishments are important factors in determining the composition of the Board. The Committee considers candidates suggested by other Board members, management and shareholders. The Committee may also retain a qualified independent third-party search firm to identify and review candidates. Mr. Haught was referred to the Company by Board member Karl J. Warnke.

The minimum qualifications a director nominee should possess include depth of knowledge in the nominee's field, diversity of experience and background, demonstrated judgment and vision to oversee and guide our business.

Once a prospective nominee has been identified, the Committee will make an initial determination as to whether to continue with a full review and evaluation. In making this determination, the Committee will take into account all information provided to the Committee, as well as the Committee's own expertise and experience. The Committee will then consider the potential candidate to ensure he or she has exhibited the criteria that the Committee has established for the position.

Our newly appointed Director, Mr. Donald C. Brown, was identified by the Corporate Governance Committee as a nominee based on his vast experience in financial reporting and accounting administration,position, as well as having an extensive understanding of operationsthe time and human resources. Additionally, he met the criteria of working for an extended period of time with a publicly traded, large-cap company.desire to effectively carry out their duties and responsibilities.

If the prospective nominee passes the preliminary review, members of the Committee, as well as other Board members as deemed appropriate, will interview the nominee. Upon completion of this process, the Committee will confer and make a recommendation to the Board. The Board, after reviewing the Committee's report, will make the final determination whether to nominate the candidate. Selection for persons identified to be appointed to a Board position will be conducted in the manner described above. Any shareholder who desires to recommend a prospective nominee for the Board should notify our Corporate Secretary in the manner described below in "Shareholder Nominations for Director."

Shareholder Nominations for Director

Shareholders may nominate candidates for election as directors if they followby following the procedures and complycomplying with the deadlines specified in our CodeRegulations. Under those procedures, any shareholder who proposes to nominate one or more candidates for election as director must, not less than 30 days prior to the meeting at which the directors are to be elected, notify the Corporate Secretary of Regulations,the shareholder's intention to make the nomination and provide the Company with all of the information about each of the candidates as maywould be amended from time-to-time.required

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 15 -

under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of the candidate, including (i) name, age, and business and residence addresses, (ii) principal occupations or employment during the last five years, (iii) the number of shares of the Company beneficially owned by the candidate, (iv) transactions between the candidate and the Company, and (v) all other information required under the rules of the SEC. A copy of our Code ofthe Regulations is available to any shareholder who makes a written request to the Corporate Secretary, and shareholders may submit nominations in writing by sending the submission to the Corporate Secretary, at The Davey Tree Expert Company, 1500 North Mantua Street, Kent, Ohio 44240.

A shareholder may nominate one or more candidates for election

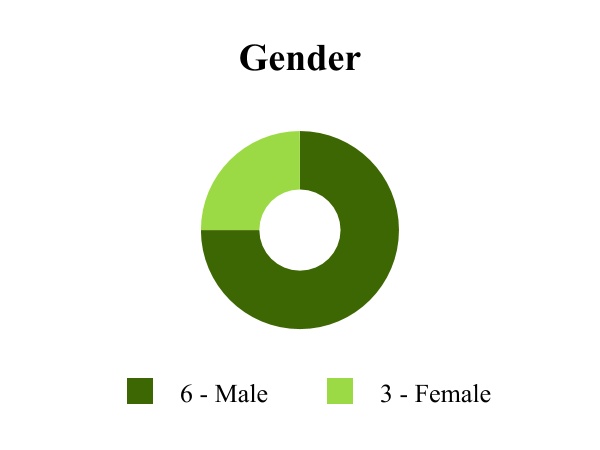

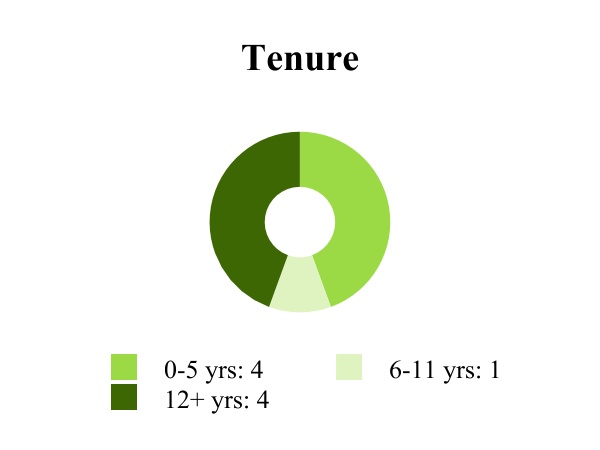

Board Diversity

The Nominating and Corporate Governance Committee and the Board considers a diverse group of experiences, characteristics, attributes and skills when considering a director nominee and the Board composition as a director by, not less than 30 days priorwhole. The Board seeks to the meeting at which the directors are to be elected, notifying our Corporate Secretarycomprise itself of his or her intention to make the nomination. The shareholder must provide us with allmembers who possess a range of the information about each of the candidates so nominated as would be required under the rules of the SEC to be included in a proxy statement.

Any submission should include details regarding the qualifications of the recommended candidate and other pertinent information. Director nominees should have high professional and personal ethics and values, requisiterelevant skills, experience, and background,expertise that relate directly to our management and must be able to representoperations. Our Board members come from a wide range of industry backgrounds, including environmental consulting, insurance, operations, finance, and executive leadership. While the interestsBoard does not maintain a formal policy regarding diversity, it recognizes that having a diverse Board with a variety of the shareholders, as well as meet the criteria setviewpoints provides a more comprehensive decision-making process and reflects an increased emphasis on gender and diversity parity by investors. The Company’s commitment is reflected, in part, by the Corporate

representative members that serve on our current Board as of April 2, 2021.

Governance Committee. Further, a nominee must have the time and desire to meet their duties and responsibilities effectively and have the potential to contribute to the effectiveness of the Board of Directors.

Shareholders may submit nominations in writing by sending such submission to Corporate Secretary, The Davey Tree Expert Company, 1500 North Mantua Street, Kent, Ohio 44240.

Independence

The Board reviews, at least annually, director independence. As part of that review, the Board considers transactions and relationships between each director and any member of his or her family, and the Company and its subsidiaries and affiliates. AllAny such relationships are reported under the heading "Transactions with Related-Persons,Related Persons, Promoters and Certain Control Persons" in this Proxy Statement. The purpose of this review is to determine whether any relationships or transactions existed or exist that could be considered inconsistent with a determination that the director is independent. Although our common shares are not listed on the New York Stock Exchange ("NYSE") or on any other exchange, with respect to determining if a director or a director nominee is independent, we useutilize the same definition of independenceSEC approved standards as useddeveloped by the NYSE, a national securities exchange.NYSE.

As a result of theirits most recent review, the Board determined that the following Directors have been identified as beingdirectors and nominees are independent: Mr. Brown, Mr. Cunningham,Ms. Evans, Mr. Ginn, Mr. Hall, Mr. Haught, Ms. Harbrecht, Ms. Kilbane, Mr. Stapleton and Mr. Warfel.Warnke. No director has been identified as a

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 16 -

lead independent director. Mr. Warnke,Covey, our Chairman, President and Chief Executive Officer, and Mr. Covey, our President and Chief Operating Officer,a current employee of the Company, is not considered an independent director.

There are not deemed to be independent directors.no family relationships between any director, executive officer or director nominee.

The Company also determined by due inquiry that no director has a relationship with our principal independent auditor, ErnstDeloitte & YoungTouche LLP ("Deloitte").

Director Retirement Policy

Our Corporate Governance Guidelines provide that could be considered inconsistent withincumbent directors are not eligible to stand for election at the end of their three-year term if they have reached the age of 70 prior the date of the Annual Meeting of Shareholders at which their term expires. However, the Board may choose to re-nominate a determination thatdirector who is above the director is independent.age limit because of such director’s unique qualifications or for business reasons necessitating continuity of the Board.

Committees of the Board of Directors; AttendanceDirectors

The Board of Directors has a Compensation Committee, an Audit Committee and a Nominating and Corporate Governance Committee, each of which has adopted a written charter. The members of each committee of the Board of Directors as of April 2, 2021 are listed in the following table:

| | | | | | | | | | | |

| Director | Compensation

Committee | Audit

Committee | Nominating and Corporate Governance

Committee |

Patrick M. Covey, Chairman | | | X |

| Donald C. Brown | X | X | |

| Alejandra Evans | | X | X |

| William J. Ginn | (Chair) | X | |

| Douglas K. Hall | X | (Chair) | |

| Sandra W. Harbrecht | X | | (Chair) |

| Catherine M. Kilbane | X | X | |

| Charles D. Stapleton | | X | X |

| Karl J. Warnke | | | X |

Compensation Committee

The present members of the Compensation Committee are Messrs. Cunningham (Chair), Ginn, Hall, and Warfel. The Compensation Committee, which is composed entirely of independent directors as that term is defined bywho meet the NYSE,NYSE's independence standards, which we follow. The Compensation Committee recommends to the Board of Directors the salaries and other compensation of our executive officers, and supervises the administration of our benefit programs.programs and assesses the risk of our compensation policies and practices. As more fully set out in the "Compensation Discussion and Analysis" in this Proxy Statement, the Compensation Committee does not delegate its authority to set compensation; however, the BoardCompensation Committee does review recommendations from our Chief Executive Officer regarding the compensation of other officers. Furthermore, the Compensation Committee periodically retains outside consultants to review and discuss compensation and benefit plans. The Compensation Committee met threetwo times in 2015.2020.

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 17 -

When utilized, the outside consultants are provided with specific instructions relating to the research to be performed. Once engaged to conduct a salary and bonus-level review, the consultants are directed to compare our plans with those of companies of similar size and in similar industries. Similarly, the consultants are directed to compare and contrast benefit plans that are applicable to private and public companies of similar size and with similar governance structures. Findings by the consultants are reviewed by the Compensation Committee and with the full Board, which then makes the final decisions regarding compensation. The Compensation Committee directed the executive officers to engage Pay Governance LLC ("Pay Governance") in 2013 to review the material features of our compensation structure in 2019, which was completedhad been previously reviewed and updated in 2014, and to update the study in 2015.2017. The Compensation Committee considered the results of these reviews and in 2015 made adjustments to thenext compensation structure as outlinedreview is scheduled to occur in the "Compensation Discussion and Analysis" beginning on page 11.2021.

Pay Governance has not provided other professional services to date, including advice related to our insurance and employee benefit programs. In 2015, we paid Pay Governance $29,600 for compensation analysis and review services. In order to perform the services that are required of them, Pay Governance does have access to certain confidential information about us; however, they do not participate in the final strategic decision-making process. Further, Pay Governance is compensated on a fee-based structure and no portion of any payment made to them is dependent upon achieving a certain result or is otherwise commission-based.

No director has been identified as having a relationship that requires disclosure as a compensation committee interlock.

Audit Committee

The present members of the Audit Committee allis composed entirely of whomindependent directors who meet the independence requirements under the NYSE's listing standards and SEC rules, are Messrs. Cunningham, Ginn, Hall (Chair), and Ms. Harbrecht. It is anticipated that Mr. Brown will become a member of the Audit Committee.rules. The Board has determined that Messrs.Mr. Brown and Cunningham qualifyqualifies as an audit committee financial expertsexpert pursuant to the SEC's rules. The Audit Committee met twofive times in 2015. In addition, the Chair and members met with management and the independent auditors by teleconference four times in 2015.2020.

The Audit Committee assists the Company's Board of Directors in fulfilling its oversight responsibilities relating to: the integrity of the Company's financial statements and financial reporting process; the Company's systems of internal accounting and financial controls; the performance of the Company's internal and independent auditors; the independent auditors' qualifications and independence; and compliance with the Company's compliance withCode of Conduct and related ethics policies and legal and regulatory requirements. Specifically, the Audit Committee oversees the appointment, engagement, compensation, termination and oversight of the Company's independent auditors, including conducting a review of their independence, reviewing and approving the planned permitted scope of the Company's annual audit, overseeing the independent auditors' audit work, reviewing and preapproving any audit and nonauditpermitted non-audit services that may be performed by the Company's independent auditors, reviewing with management and the Company's independent auditors the adequacy and effectiveness of the Company's internal control over financial reporting and disclosure controls, and reviewing the Company's critical accounting policies and the application of accounting principles.

In addition, the Audit Committee establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting control over financial reporting or auditing matters and the confidential anonymous submission by employees of concerns regarding questionable accounting or auditing matters. The Audit Committee's role also includes meeting to review the Company's annual audited financial statements and quarterly financial statements with management and the Company's independent auditors. The Audit Committee annually reviews the independence and performance of the independent auditor in connection with any determination of whether to retain the independent auditor or engage another firm as our independent auditor. In the course of these reviews, the Committee considers, among other things, the historical and recent performance, and an analysis of known legal risks and significant proceedings.

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 18 -

Nominating and Corporate Governance Committee

The present members of the Corporate Governance Committee are Messrs. Covey, Warfel (Chair),Stapleton and Warnke and Ms. Harbrecht. It is anticipated that Mr. Brown will become a member of the Corporate Governance Committee. Messrs. BrownMss. Evans and Warfel and Ms. Harbrecht are independent directors who meet the NYSENYSE's independence standards.standards; the other Committee member, Mr. Covey, is not. The Nominating and Corporate Governance Committee screens and recommends candidates for election as directors and recommends committee members and committee chairpersons for appointment by the Board of Directors. The Committee will consider nominees for the Board of Directors recommended by our shareholders.

In addition, the Committee reviews, evaluates and recommends changes to the Company's corporate governance policies, and monitors the Company's compliance with these policies.

The Committee also conducts annual performance evaluations of the Board and the committees of the Board.Board and sets and interprets the Board standards for the determination of director independence. The Nominating and Corporate Governance Committee met two times in 2015.2020.

Compensation Committee Interlocks and Insider Participation

No director has been identified as having a relationship that requires disclosure as a compensation committee interlock.

General

NonindependentNon-independent directors may not serve on the Compensation or Audit Committee. Independent directors generally serve on at least two committees.

The Board met five times in 2015.2020. All incumbent directors attended at least 75%100% of the meetings of the Board of Directors and of the committees on which they served during the period that they served. We encourage our directors to attend the Annual Meeting of Shareholders. In 2015,2020, all of our then-serving directors attended the virtual Annual Meeting of Shareholders.

The charters of the Compensation, Audit and Nominating and Corporate Governance committees, as well as the Corporate Governance Guidelines, are available on the Company's website at www.davey.comwww.davey.com/about/corporate-information/ under the tab "Corporate Information," at the bottom of the pageand then under "Board Committee Charters," or by contacting the Corporate Secretary at The Davey Tree Expert Company, 1500 North Mantua Street, Kent, Ohio 44240.

Role of the Board in Risk Oversight

The Board recognizes that it is neither possible nor prudentreasonable to eliminate all risk, and that in order to remain competitive, certain risk-taking is an essential element of every business decision and part of our business strategy. However, the Board also understands that within any business framework, steps must be taken to properly safeguard the assets of the Company, implement and maintain appropriate financial and other controls, and ensure that business is conducted sensiblyprudently and in compliance with applicable laws and regulations and proper governance.

Assessing and managing risk is the responsibility of management. It is the responsibility of the Board of Directors to oversee risk management. As part of this responsibility, the Board oversees and reviews certain aspects of our risk management efforts. For example, the Board requires that an annual overall assessment of risk be performed and has delegated this oversight of thethis process to the Audit Committee. This enterprise-wide risk management assessment is designed to review and identify potential events that may affect us,

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 19 -

including cybersecurity risks, manage risks within our risk profile and provide reasonable assurance regarding the achievement of our objectives. The Audit Committee reviews and discusses with management our major financial risk exposures and the steps management has taken to monitor and control such exposures, including our financial risk assessment and risk management policies. Other strategic and operational risk exposures monitored and assessed by the Board may include regulatory, human capital and reputation risks. The Compensation Committee oversees risks related to our employment policies and our compensation and benefit arrangements. In addition, management and the Board have recently focused on risks relating to, and impact on the Company from, the COVID-19 pandemic during the last 12 months, and will continue to do so while the pandemic is ongoing.

We are aware that cybersecurityCybersecurity is an integral part of our risk analysis and discussions. While all entities are at some risk of a cybersecurity attack, the Company has taken steps deemed appropriate by the Company to detect and limit the severity of a cybersecurity attack. These measures include, among other things, robust password requirements, firewalls, and limiting access to sensitive information. To date, the Company is not aware of any successful system-wide cybersecurity attack. The Company maintains employee and customer information and has developed contingencyresponse plans butin the event such information is compromised due to a cybersecurity attack. The Company also has not developed a system-wide cybersecuritythird party on a retainer to assist with forensics and remediation should an attack cost matrix.occur.

Company representatives meet annually in executive session with the Audit Committee. The General AuditorManager of Internal Audit and the Chief Financial Officer review with the Audit Committee each year's annual internal audit plan, which focuses on significant areas of financial, operating and compliance risk. The Audit Committee also receives regular reports from management on the results of internal audits.

In addition, each year, our management team conducts an assessment of potential risks facing us and reports theirits findings to the Audit Committee. Risks are rated as to severity and the likelihood of threat, and management outlines the mitigation efforts associated with each risk. To the extent management identifies mitigation efforts that were not in place, management identifies the initiative to address the particular situation. The Audit Committee then reports these findings to the full Board to assist in its oversight of risk. Moreover, in 2014, our management team completed a risk assessment consistent with the framework in Internal Control - Integrated Framework (2013) issued by theThe Audit Committee of Sponsorship Organizationsalso has oversight of the Treadway Commission ("COSO 2013").Company's Compliance Program, which includes regular reports from the General Counsel and Compliance Officer on compliance strategy and management.

As further described under "Compensation Risk Analysis," the Compensation Committee is responsible for the oversight of risks relating to employment policies and our compensation and benefits arrangements. To assist in satisfying these oversight responsibilities, the Committee may retain a compensation consultant and meets regularly with management to understand the financial, human resource and shareholder implications of compensation decisions that are made by the Board. The philosophy, process and rationale the Compensation Committee utilizedutilizes as part of its responsibilities is discussed in detail in the "Compensation Discussion and Analysis" included in this Proxy Statement beginning on page 11.28.

Board Leadership

Mr. WarnkeCovey is the Chairman of our Board of Directors and our President and Chief Executive Officer. OurOfficer, having assumed responsibility as Chairman of our Board hasof Directors effective March 6, 2020 from Mr. Warnke who retired as chairman but remains on the authority to choose its chairman in any way it deems best for us at any given point in time. Board.

Historically, we have combined the positions of chief executive officer and chairman. We believe this is appropriate because we are an Employee Stock Ownership Plan ("ESOP"(“ESOP”) company and combining the chairman and chief executive officer positions gives our employee-owners a clear leader and improves efficiencies in the decision-making process. We believeFurther, we have greatly benefited from having a single

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 20 -

person setting our tone and direction and having primary responsibility for managing our operations. This structure has also allowed the Board to carry out its oversight responsibilities with the full involvement of our independent directors. To date,

Although the Board's role inBoard does not intend to appoint a lead independent director, the Board believes that it is able to effectively provide independent oversight of risk assessment has not caused it to identify any changes toour business and affairs, including risks facing the currentCompany, through the composition of our board of directors and the strong leadership structure. However,of our independent directors.

The Board believes there isthat no single leadership structure that would beis the most effective in all circumstances and therefore, retains the authority to evaluate and modify the Company’s leadership structure at such times as it deems appropriate. The Board’s role in risk oversight has not impacted our leadership structure to best address our circumstances as and when appropriate.structure.

Corporate Responsibility

We understand our corporate responsibility is to maintain shareholder value through continued economic sustainability. In fulfilling this responsibility to our shareholders, substantially all of whom are current or past employees or immediate family members or trusts of current or former employees, we are cognizant that economic sustainability is multifaceted. We understand that one facet relates to our environmental stewardship. As outlined in our 2014 Corporate Responsibility Report, which was published in 2015, we respect the connection between our services and our impacts on employees, clients, the natural environment and communities. We also have an Environmental Policy, which is available on our website at www.davey.com under the tab "Corporate Information" at the bottom of the page, then under "Corporate Policies." We will continue to monitor our activities as a responsible corporate citizen and will continue to review our business practices in light of our corporate responsibility.

Communicating Concerns to Directors

We have established procedures to permit communications with the Board of Directors regarding the Company. Interested parties may communicate with the Board of Directors by contacting the Chairman, the chairs of the Audit, Compensation and Nominating and Corporate Governance Committees of the Board, or with any independent Directordirector by sending a letter to the following address: The Davey Tree Expert Company, Corporate Secretary, 1500 North Mantua Street, Kent, Ohio 44240.

An interested party may also communicate concerns through other mediums as set forth in our Whistleblower Conduct Reporting Policy. A copy of our Whistleblower Conduct Reporting Policy is available on our Company's website at www.davey.comwww.davey.com/about/corporate-information/ and then under "Corporate Policies," or by contacting the Corporate SecretaryLegal Department at The Davey Tree Expert Company, 1500 North Mantua Street, Kent, Ohio 44240.

All communications directed to our Board of Directors or Board Committees are reviewed by management and communicated with the appropriate Board member or members.

Transactions with Related Persons, Promoters and Certain Control Persons

Our Board of Directors has adopted a written policy regarding related party transactions. Under that policy, all transactions with or involving a related person must be disclosed to and approved in advance by the Nominating and Corporate Governance Committee. Further, each officer and director is requested, on an annual basis, to confirm the existence of any related person transaction. Each such transaction must have a legitimate business purpose and be on terms no less favorable than that which could be obtained from unrelated third parties. Related party transactions are considered when determining if a director is deemed to be an independent director.

In 2020, no executive officer, director or director nominee was indebted to us or was a party to any transaction in which any related person would have a direct or indirect material interest. Further, no related person has proposed such a transaction. For purposes of this discussion, a related person is a director, a nominee for director, an executive officer, an immediate family member (including nonrelated persons sharing the same household) of any of these persons, or any entity controlled by any of these persons.

Environmental Stewardship

We understand our corporate responsibility is to maintain shareholder value through continued economic sustainability. In fulfilling this responsibility to our shareholders, most of whom are current or past employees or immediate family members or trusts of current or former

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 21 -

employees, we are cognizant that economic sustainability is multifaceted. We understand that one facet relates to our environmental stewardship. As outlined in our annual Corporate Responsibility Report, we respect the connection between our services and our impacts on employees, clients, the natural environment and communities. This report is available on our website at www.davey.com/about/corporate-responsibility/ and then under the tab "Corporate Responsibility." This report is not incorporated by reference into, and is not a part of, this Proxy Statement. We will continue to monitor our activities as a responsible corporate citizen and review our business practices in light of our corporate responsibility.

We have a long-standing tradition of giving back to our communities across the U.S. and Canada, and we encourage our employees to get involved in the communities where they live and work to help grow a better future. In 2018, we launched the Green Leaders program, which recognizes employees’ volunteer activities that are meaningful to them, as well as supporting initiatives that promote trees, sustainable landscapes and the environment. In 2020, employees invested over 8,900 hours to organizations that were meaningful to them.

Employee Ownership

In 1979, the Company was sold to its employees by the family and descendants of the Company's founder. At that time, in addition to the employees purchasing common shares of the Company, the Company formed an ESOP, which was later converted to the 401KSOP and ESOP Plan. The Company has remained largely employee-owned since the sale in 1979, and employee ownership remains a hallmark of the Company. Currently, the Company is one of the largest and oldest ESOP service firms in the United States.

Our values — safety, integrity, expertise, leadership, stewardship and perseverance — are built on the foundation that our people are the key to our success and sustainability as a company. We aim to engage and inspire our employees every day, providing them with education and development opportunities to help them grow personally and professionally. As a provider of arboricultural, horticultural, environmental and consulting services, attracting and retaining top talent is critical to our success. We actively recruit candidates who share our commitment to advance the green industry. While our industry faces challenges of seasonal employment and high average turnover, our structure as an employee-owned company enables our talented employees to invest in us as we invest in them. Our recruiting and employee development team cultivates employee strength by recruiting, training and retaining a diverse and talented workforce.

In addition to offering employees a means to earn a paycheck and obtain employee benefits, employees have the opportunity to become shareholders of the Company. We offer fair, competitive compensation and benefits that support our employees’ overall health and well-being but recognize that supporting our employees does not end there. We encourage employees to plan for their future, and after one year of service, our employees are eligible to invest in our 401(k) plan, where we will match up to 5% of employees’ contributions, or by becoming a shareholder and enrolling in our stock purchase plan, where they can purchase shares of the company at a 15% discount. We also offer a family scholarship program to assist employees with approved college education tuition and expenses for their children and legal wards. This has allowed the Company to grow and become a stable yet progressive institution. Our decisions regarding our business, our growth, and our compensation plans are directly influenced by our employee ownership nature.

Core to our values is being there for our people when the unexpected happens. We have two employee assistance programs in place to support our employees. The first is our emergency employee assistance program, which provides grants to employees for food, shelter and other basic needs due to unexpected financial hardships. The second is our COVID-19 relief program through the Davey Company Foundation, which provides tax-free payments to employees for eligible expenses incurred as a result of the pandemic.

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 22 -

Shareholder Proposals

The Company provides its shareholders with a process to submit shareholder proposals for consideration at the annual shareholder's meeting. Any shareholder who wishes to submit a proposal to be considered for a vote must follow the requirements set out in SEC Rule 14a-8, which include, among other things, certain ownership requirements. Further, the proposal must be limited to 500 words.

Any shareholder who wishes to submit a proposal to be considered for inclusion in next year’s Proxy Statement should send the proposal to us on or before December 6, 2021. Additionally, a shareholder may submit a proposal for consideration at next year’s Annual Meeting of Shareholders, but not for inclusion in next year’s Proxy Statement, if that proposal is submitted on or before February 19, 2022. The requirements for shareholders to submit nominees for director are discussed under "Shareholder Nominations for Director."

Business Conduct Policies

We have a Code of Ethics that applies to all of our employees and directors and we have a Code of Ethics for Financial Matters that applies to all employees and directors, but particularly those who oversee the preparation of our financial statements. TheWe also have a Harassment Policy, an Equal Employment Opportunity Policy, a Whistleblower Policy, an Environmental Policy and a Privacy Policy. These policies are available at our website, www.davey.comwww.davey.com/about/corporate-information/ under the tab "Corporate Information" at the bottom of the pageand then under "Corporate Policies," or by contacting the Corporate Secretary at The Davey Tree Expert Company, 1500 North Mantua Street, Kent, Ohio 44240.

Transactions | | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 23 -

2020 DIRECTOR COMPENSATION

| | | | | | | | | | | |

Director(1) | Fees Earned or

Paid in Cash(2) | Stock Awards(3) | Total |

| Donald C. Brown | $ | 60,000 | | $ | 36,010 | | $ | 96,010 | |

| Alejandra Evans | 60,000 | | 36,010 | | 96,010 | |

| William J. Ginn | 66,000 | | 36,010 | | 102,010 | |

| Douglas K. Hall | 70,000 | | 36,010 | | 106,010 | |

| Sandra W. Harbrecht | — | | 36,010 | | 36,010 | |

| Catherine M. Kilbane | 60,000 | | 36,010 | | 96,010 | |

| Charles D. Stapleton | 48,000 | | 36,010 | | 84,010 | |

| Karl J. Warnke | 30,938 | | 36,010 | | 66,947 | |

(1) Mr. Covey is an employee and does not receive any compensation for services as director.

(2) Directors may elect to defer all or part of their director fees in stock equivalent units ("SEUs"). Ms. Harbrecht, Mr. Stapleton and Mr. Warnke made such an election for the year ended December 31, 2020. SEUs are calculated by dividing the fee earned by the then current market price of the Company's common shares. SEUs will subsequently be valued for payment purposes at the market price in effect on the date of payment. SEUs are payable, in cash, upon the recipient's termination of service as a director.

(3) This column reflects the grant date fair value of Director Restricted Stock Unit ("DRSU") awards granted to directors in 2020. The assumptions made in calculating the grant date fair value amounts for these awards are included in Note N, "Stock-Based Compensation," to the consolidated financial statements included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

The aggregate number of all vested and unvested (exercisable and unexercisable) Stock Appreciation Rights ("SARs") awards and unvested DRSU awards for each nonemployee director, outstanding as of December 31, 2020, is set forth in the following table.

| | | | | | | | |

| Director | SARs (Exercisable

and Unexercisable) | DRSU |

| Donald C. Brown | — | | 3,253 | |

| Alejandra Evans | — | | 2,625 | |

| William J. Ginn | 12,000 | | 3,253 | |

| Douglas K. Hall | 12,000 | | 3,253 | |

| Sandra W. Harbrecht | — | | 3,253 | |

| Catherine M. Kilbane | — | | 3,253 | |

| Charles D. Stapleton | — | | 1,488 | |

| Karl J. Warnke | — | | 3,253 | |

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 24 -

2020 DIRECTOR COMPENSATION

Compensation of Directors

The current compensation structure for nonemployee directors is designed to fairly pay directors for work required based on our size, scope and industry. The primary goal of the directors is to enhance the long-term interests of our shareholders by establishing company-wide general goals and objectives and identifying executive officers capable of carrying out those goals and objectives. In order to align director compensation with Related-Persons, Promotersthese objectives, the Compensation Committee reviews director compensation and Certain Control Personsrecommends changes to the Board. To assist with this review, the Compensation Committee periodically directs the Company to engage Pay Governance, an independent compensation consulting firm, to review and evaluate director compensation. Pay Governance assists us in developing a framework for director compensation based on market conditions, our compensation philosophy, and comparisons to companies of similar size and complexity. A review by Pay Governance was completed in 2020 and the Compensation Committee recommended no changes be made to director compensation. Another review is scheduled to occur in 2021.

Our2020 Director Compensation

We compensate nonemployee directors with a retainer of $60,000 per year, unless there are more than 20 meetings total per year, in which case each director would receive an additional fee of $1,000 per meeting. Committee Chairs received an additional retainer as follows: Audit Committee Chair - $10,000/year; Compensation Committee Chair - $6,000/year; and Nominating and Corporate Governance Committee Chair - $5,000/year. If the Chairman of the Board is a non-employee director, the Chairman will receive an additional retainer of $7,500/year. Directors has adoptedare also reimbursed for their reasonable business expenses such as travel and lodging in connection with their attendance of our Board meetings.

Each nonemployee director receives an annual stock award grant of DRSUs equal to a written policy regarding related-party transactions. Under that policy, all transactionsfixed amount of $36,000. In 2020, the annual grant, at the then-fair value price of $24.20, equaled 1,488 DRSUs awarded to each director. The number of DRSUs associated with or involving a related-personthe award will fluctuate based on the fair value price of the Company's common shares; however, the value of $36,000 will remain constant. The award will vest over three years and vesting will accelerate upon retirement. Beginning with the 2017 award, an award may be paid in one-to-five-year installments, but must be disclosedpaid in full by age 75.Vested DRSUs will generally be paid to and approvednonemployee directors on March 15 of the year following the year in advance by the Corporate Governance Committee. Further, each officer andwhich their service on our Board ceases. Nonemployee directors may make a deferral election with respect to DRSUs. A nonemployee director is requested, on an annual basis,may elect to confirm the existence of any related-person transaction. Even if disclosed, each such transaction must have a legitimate business purpose and be on terms no less favorabledeferred payment made in a single lump sum payment during a specified year not later than that which could be obtained from unrelated third parties. Related-party transactions are considered when determining if a director is deemed to be an independent director.

In 2015, no executive officer, director or director nominee was indebted to us or was a party to any transactionthe year in which any related-person will havethe nonemployee director attains age 75 or in a directseries of installments over a period not to exceed five years commencing in a specified year not later than the year in which the nonemployee director attains age 70.

Directors may defer all or indirect material interest. Further, no related-person has proposed such a transaction. For purposespart of this discussion, a related-person is a director, a nominee for director, an executive officer, an immediate family member (including nonrelated-persons sharing the same household)their fees in cash or SEUs until their retirement as directors.

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 25 -

OWNERSHIP OF COMMON SHARES

The following table shows, as of March 17, 2016,12, 2021, the number and percent of our common shares beneficially owned by each nominee, director, and officer listed in the "2015"2020 Summary Compensation Table," and all directors, nominees and officers as a group.

| | | | | | | | |

| Name | Number of Shares (1)(2)(3)(4) | Percent(2)(5) |

| Patrick M. Covey (Chairman) | 394,426 | | 1.71 | % |

| Donald C. Brown | 29,068 | | 0.13 | % |

| Alejandra Evans | — | | — | % |

| William J. Ginn | 48,457 | | 0.21 | % |

| Douglas K. Hall | 127,899 | | 0.56 | % |

| Sandra W. Harbrecht | 111,475 | | 0.49 | % |

| Thomas A. Haught | — | | — | % |

| Catherine M. Kilbane | 1,824 | | 0.01 | % |

| Charles D. Stapleton | — | | — | % |

| Karl J. Warnke | 981,383 | | 4.29 | % |

| Joseph R. Paul | 268,457 | | 1.17 | % |

| James F. Stief | 326,049 | | 1.42 | % |

| Erika J. Schoenberger | 3,172 | | 0.01 | % |

| Brent R. Repenning | 111,888 | | 0.49 | % |

| 19 directors, director nominees and officers as a group, including those above | 3,003,520 | | 13.10 | % |

(1) Other than as described below, individuals who have beneficial ownership of the common shares listed in the table have sole voting and investment power over these shares.

(2) The following persons share voting and investment power with a spouse with respect to the following number of shares: Mr. Brown, 23,000; Mr. Hall, 88,047; Mr. Warnke, 289,930; Mr. Stief, 115,298; and Mr. Repenning, 12,868.

(3) Includes shares allocated to individual accounts under our 401KSOP and ESOP Plan for which the following executive officers have sole voting power as follows: Mr. Covey, 12,738 shares; Mr. Paul, 9,257 shares; Mr. Stief, 53,774 shares; Ms. Schoenberger, 639; Mr. Repenning, 6,136 shares; and 197,693 shares by all officers as a group.

(4) These numbers include the right to purchase common shares on or before May 11, 2021 upon the exercise of outstanding stock options: Mr. Covey, 28,872 shares; Mr. Paul, 14,843 shares; Mr. Stief, 26,043 shares; Ms. Schoenberger, 1,843 shares; Mr. Repenning, 22,043 shares; and 135,279 shares by all directors and officers as a group. These numbers also include the right to purchase common shares on or before May 11, 2021 upon the exercise of outstanding SARs: Mr. Covey, 140,503 shares; Mr. Paul, 106,593 shares; Mr. Stief, 12,471 shares; Mr. Repenning, 25,108 shares; and 389,695 common shares by all directors and officers as a group.

(5) Percentage calculation based on total shares outstanding as of March 12, 2021 plus the options and rights exercisable by the respective individual on or before May 11, 2021, in accordance with Rule 13d-3(d) of the Securities Exchange Act of 1934, as amended.

|

| | | | |

| Name | Number of Shares (1)(2)(3)(4) | Percent(2)(5) |

| Karl J. Warnke | 492,606 |

| 3.70 | % |

| Donald C. Brown | — |

| — | % |

| J. Dawson Cunningham | 18,095 |

| .14 | % |

| William J. Ginn | 5,726 |

| .04 | % |

| Douglas K. Hall | 44,627 |

| .34 | % |

| Sandra W. Harbrecht | 22,706 |

| .17 | % |

| John E. Warfel | 8,959 |

| .07 | % |

| Patrick M. Covey | 56,033 |

| .42 | % |

| Joseph R. Paul | 36,817 |

| .28 | % |

| Steven A. Marshall | 126,726 |

| .95 | % |

| James F. Stief | 182,401 |

| 1.37 | % |

| 21 directors and officers as a group, including those listed above (6) | 1,420,784 |

| 10.67 | % |

| |

(1) | Other than as described below, beneficial ownership of the common shares listed in the table is comprised of sole voting and investment power, or voting and investment power shared with another person. |

| |

(2) | Includes shares allocated to individual accounts under our 401KSOP and ESOP Plan for which the following executive officers have sole voting power as follows: Mr. Warnke, 48,373 shares; Mr. Covey, 5,372 shares; Mr. Paul, 2,931 shares; Mr. Marshall, 62,957 shares; Mr. Stief, 25,367 shares; and 274,811shares by all officers as a group. |

| |

(3) | These numbers include the right to purchase common shares on or before May 16, 2016 upon the exercise of outstanding stock options: Mr Warnke, 3,400 shares; Mr. Covey, 15,600 shares; Mr. Paul, 9,600 shares; Mr. Marshall, 27,800 shares; Mr. Stief, 10,000 shares; and 133,471 common shares by all directors and officers as a group. These numbers also include the right to purchase common shares on or before May 16, 2016 upon the exercise of outstanding stock appreciation rights: Mr. Warnke, 27,507 shares; Mr. Covey, 11,591 shares; Mr. Paul, 4,523 shares; Mr. Marshall, 9,441 shares; Mr. Stief, 6,151 shares; and 96,490 common shares by all directors and officers as a group, and the right to purchase common shares on or before May 16, 2016 upon the exercise of Stock Rights under the Stock Subscription program; Mr. Warnke, 1,112 shares; Mr. Covey, 208 shares; Mr. Paul, 836 shares; Mr. Marshall, 832 shares; Mr. Stief, 313 shares and 12,321 common shares by all directors and officers as a group. |

| |

(4) | Of the shares listed, the following number of shares were pledged as security: 36,614 shares by all directors and officers as a group. |

| |

(5) | Percentage calculation based on total shares outstanding plus the options and rights exercisable by the respective individual on or before May 16, 2016, in accordance with Rule 13d-3(d) of the Securities Exchange Act of 1934, as amended. |

To our knowledge, as of March 17, 2016,12, 2021, no person or entity was an owner, beneficial or otherwise, of more than five percent of our outstanding common shares. Argent Trust Company, trustee of the 401KSOP and ESOP Plan, 1100 Abernathy Road, 500 Northpark, Suite 550, Atlanta, GA 30328, had, as of March 17, 2016,12, 2021, certain trustee-imposed rights and duties with respect to common shares held by it. The number of common shares held in the 401KSOP and ESOP Plan as of March 17, 2016,12, 2021, was 3,785,447,5,077,409 or 28.48%22.18% of our outstanding common shares.

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 26 -

OWNERSHIP OF COMMON SHARES

Delinquent Section 16(a) Beneficial Ownership Reporting ComplianceReports

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers and persons who own more than ten percent of our common shares to file reports of ownership and changes in ownership of our common shares held by them with the SEC. Currently, we file these reports on behalf of our directors and executive officers. Based on our review of these reports, we believe during the year ended December 31, 2015, except as follows,2020, all reports were timely filed. The Form 4 for the exercise

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 27 -

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

The Compensation Discussion and Analysis section of the Proxy Statement providesdiscusses the Company's shareholders withcompensation of the NEOs and includes an overview of our 2020 performance, as well as a description of the major elements of the Company's executive officer compensation plans and programs, as well asand the principles and factors that are considered in making compensation decisions.

The members of the Compensation Committee of the Board of Directors, ("we" or "us" as used in this Compensation Discussion and Analysis), which is composed entirely of independent, nonemployee directors, assistassists the Board of Directors ("Board" or "Board of Directors") in carrying out its responsibilities for management succession matters, for developing, approving and administering the Company's executive officer incentive and benefits programs for its executive officers, for establishing the base salary and other compensation for the Chief Executive Officer, and for recommending director compensation. In this role, we are carefulthe Compensation Committee's objective is to align executive officer compensation with the interests of the Company's shareholders, review all proposed compensation programsshareholders.

Financial Performance Overview

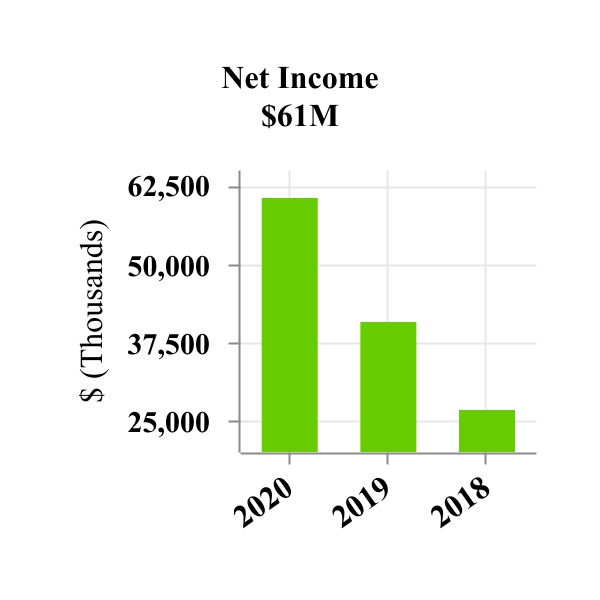

2020 Financial and program changes,Operating Highlights

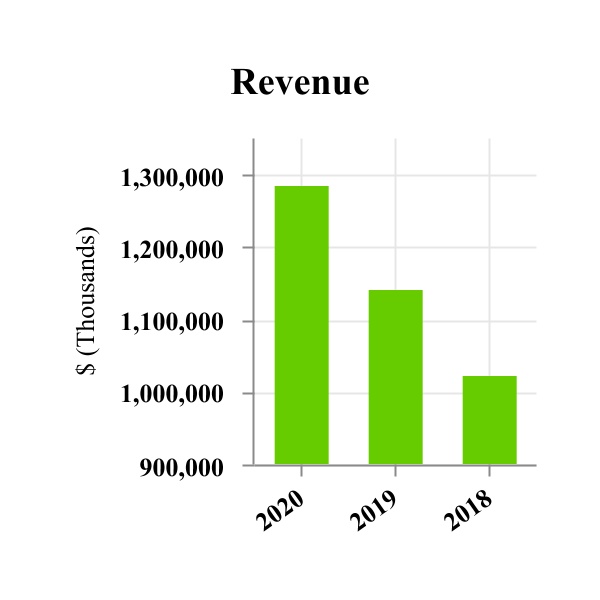

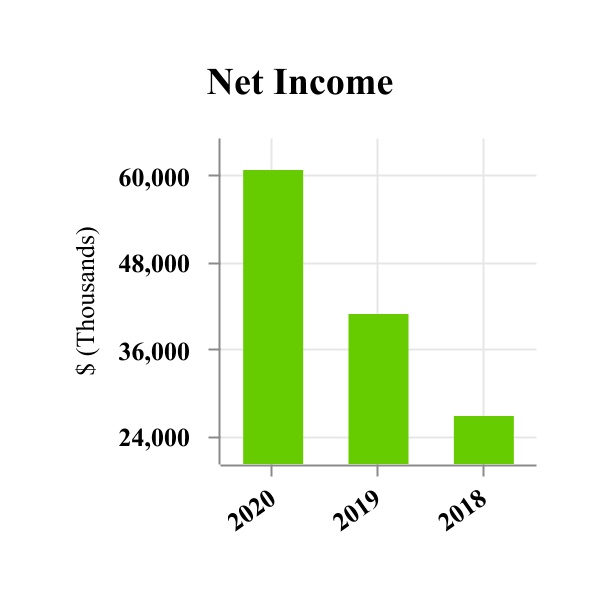

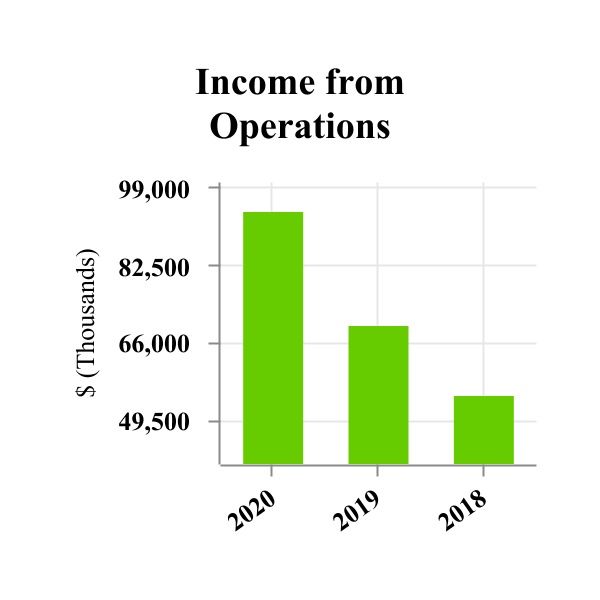

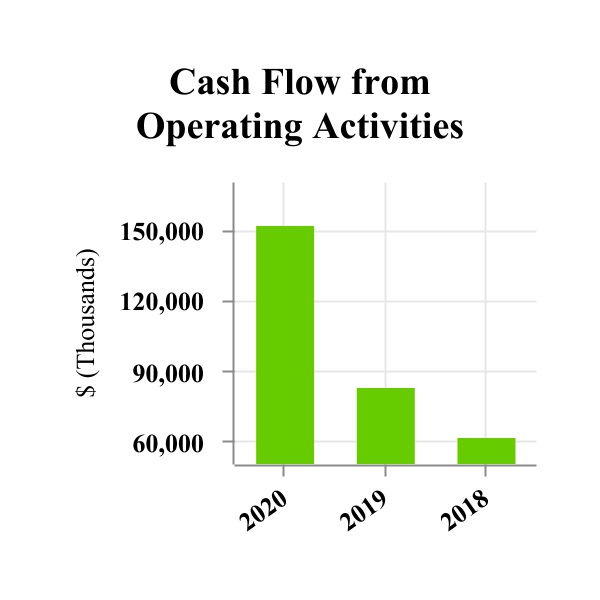

Our results in 2020 exceeded our expectations. Revenues increased by $143,832,000, or 12.6%, and discuss recommendationsincome from operations was $94,201,000, an increase of 34.7% from 2019. During 2020, the Company dealt with the full Board for final approval.

The following discussion relates to the compensationmany challenges that arose, as a result of the Company's Named Executive Officers or "NEOs." For 2015,COVID-19 pandemic. Our business segments, and divisions underlying those segments, provided strong performances and demonstrated their flexibility and commitment while navigating the Company's NEOs include Karl J. Warnke, Principal Executive Officer ("PEO"), Joseph R. Paul, Principal Financial Officer ("PFO"),frequently changing guidance and restrictions imposed during the other executive officers namedpandemic. We were also successful in the "2015 Summary Compensation Table" in this Proxy Statement.

| |

II. | 2015 Financial Performance Overview and Highlights |

Despite the continued restrained growth in the U.S. economy ascontinuing to service our customers and keep our employees safe. We benefitted from a whole, the Company maintained its growth strategyvery active storm season and achieved record-setting revenues and operating profit in many of the Company's divisions and subsidiaries. Specifically, in 2015 the Company:

Generated cash flow from operating activities of $62,689,000 (as set forth on page F-7 in the Company's Form 10-K for the fiscal year ended December 31, 2015);

Achieved operating profit, as defined in our description of operating profit on page 15, of $54,177,000 or 6.6%;

Realized return on average invested capital of 17.31%;

Increased revenues by $31,993,000, or a 4.1% increase over 2014 revenues;

Completed multiplealso completed five business acquisitions in strategic geographic regions and markets; and,

Continued to implement the Company's Vision 2020 growth and value strategy.

Except for operating profit, all financial results noted above are based on the Company's audited financial statements prepared in accordance with accounting principles generally accepted in the United States ("U.S. GAAP"). Operating profit is defined abovein 2020.

We consistently return significant value to our shareholders in the form of dividends and is discussed under the Annual Incentive Compensation Plan captionrepurchases of our stock. Dividends paid in Section IV2020 totaled $2,271,000 and repurchases of this Compensation Discussion and Analysis.stock totaled $39,079,000.

| | | | | | | | |

III.The Davey Tree Expert Company - 2021 Proxy Statement | | Philosophy and Elements of Executive Compensation Structure and Components |

- 28 -

COMPENSATION DISCUSSION AND ANALYSIS

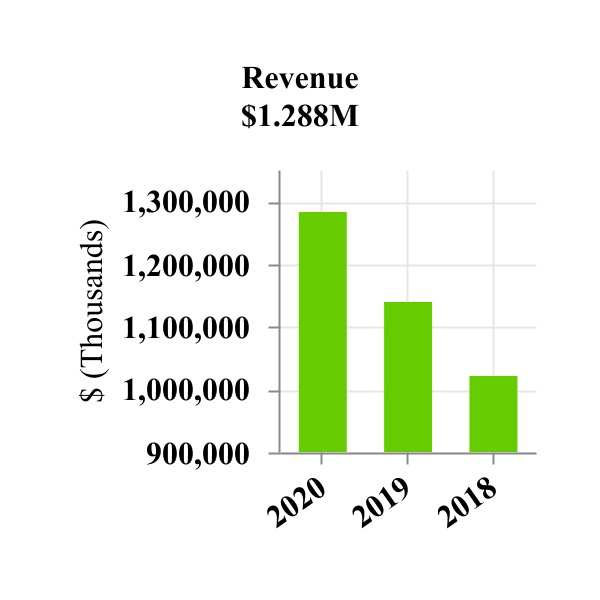

The following graphs show our Company’s performance for key financial measures over the last three fiscal years.

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 29 -

COMPENSATION DISCUSSION AND ANALYSIS

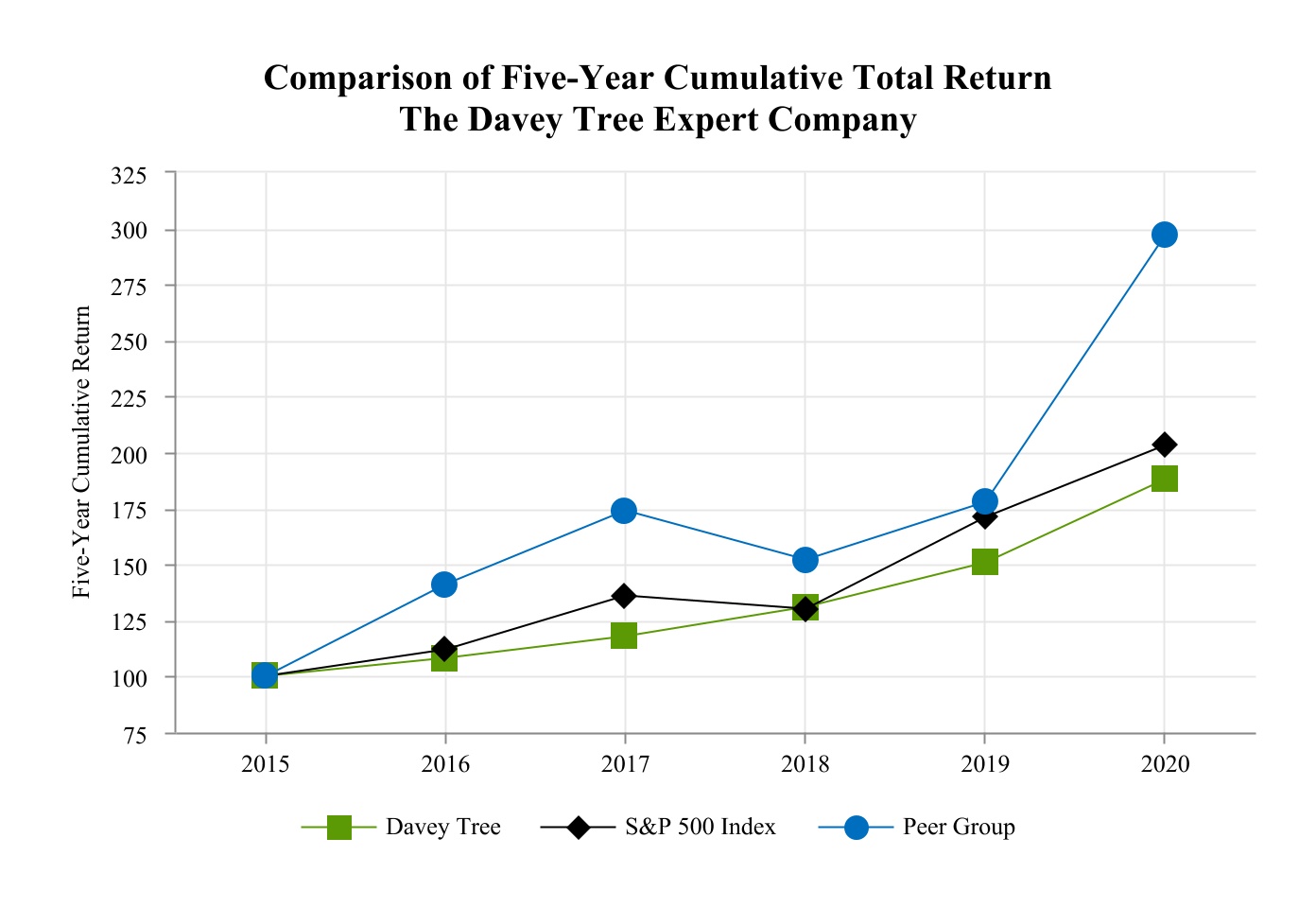

The following performance graph compares cumulative total shareholder returns (assuming an initial investment of $100 on December 31, 2015 and reinvestment of dividends) for our common shares during the last five years to the Standard & Poor's 500 Stock Index (the "S&P 500 Index") and to an index of selected peer group companies ("Peer Group"). Our Peer Group, which is the same group used by our independent stock valuation firm, consists of: ABM Industries Incorporated; Comfort Systems USA, Inc.; Dycom Industries, Inc.; FirstService Corporation; MYR Group Inc.; Quanta Services, Inc.; Rollins, Inc.; and The Scotts Miracle-Gro Company The peer group are all publicly held companies deemed to be engaged in similar lines of business.

The Company continues to achieve its objective of consistently providing increased shareholder returns for our common stock.

| | | | | | | | | | | | | | | | | | | | |

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Davey | 100 | 108 | 118 | 131 | 151 | 188 |

| S&P 500 Index | 100 | 112 | 136 | 130 | 171 | 203 |

| Peer Group | 100 | 141 | 174 | 152 | 178 | 297 |

Changes in Executive Compensation

In 2020, the Company, with approval from the Compensation Committee and Board of Directors, amended the Long-Term Incentive Plan to discontinue the stock option program for 2021 and going forward and replace the value to recipients of those awards with performance-

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 30 -

COMPENSATION DISCUSSION AND ANALYSIS

based restricted stock units ("PRSUs") for reasons set forth under “Performance-Based Restricted Stock Units.” In addition, PRSU awards granted after March 1, 2021 vest in three years rather than five years.

The Company made no other changes to any of the executive compensation plans during 2020, except base salary adjustments as described below.

Philosophy and Elements of Executive Compensation Structure and Components

Aligning Compensation to Company Performance and Shareholder Value

Our compensation philosophy is to drive and support the Company's business goals by recognizing the attainment of measurable performance and the achievement of approved goals and objectives. In addition, we regularly assess whether the Company's compensation structure establishes appropriate incentives for management and employees, and validate that awards are made with due consideration of balancing risks and rewards.

The Company's compensation programs are designed to reward employees for producing sustainable growth for the Company's shareholders and to attract and retain qualified and experienced talent. ATo drive this philosophy, a significant part of the compensation for senior executives is tied to Company performance or achievement of certainapproved performance goals and, therefore, is not guaranteed. If the Company or an executive fails to perform within established parameters for a given fiscal year, incentive compensation may be changed, reduced or eliminated.eliminated, and if our stock price decreases, stock-based compensation will become less valuable.

We believe our executive officer compensation programs are closely aligned with the interests of the Company's shareholders. Among other things, as discussed more fully under the heading "Annual Incentive Compensation Plan," a significant portion of the NEOs' annual pay is comprised of the Management Incentive Compensation Plan ("MICP") payment. The weighting toward MICP payments is designed to link a substantial percentage of the NEOs' pay to goal achievements and Company performance. In order to also focus management's attention on the future growth and development of the long-term performance of the Company, incentives reflect competitive market levels and practices, and focus on longer-term financial performance, sustainability, and strategic development of the Company.

For 2020, executive management objectives included revenue, operating profit, growth, acquisitions and management succession goals. With regard to these objectives, in 2020, the Company's revenues were a record high and increased 12.6% over the prior year revenue. Operating profit (a non-GAAP measure as defined in this Proxy Statement) was $102,041,000 in 2020 and the Company achieved an operating profit percentage of 7.9%. Moreover, the Company completed five acquisitions and each NEO was engaged in management succession planning, both with the assistance of the Board of Directors and with other officers and managers of the Company.

Objectives of Compensation Structure and Components

The main objectives of theour compensation programs are to:

•attract and retain qualified personnel;

•reward personnel for achieving recognized goals and objectives;

•generate a fair return to shareholders on their investment; and do so in a way consistent with

•support the Company's culture, business objectives and employee ownership structure.

In order to meet these objectives, we design the Company's compensation programs such that shareholders' interests are advanced before we approve any incentive payments to the executive officers. To the extent that the efforts of the executive officers result in higher

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 31 -

COMPENSATION DISCUSSION AND ANALYSIS

earnings and enhanced shareholder value, we believe theour officers should be rewarded. As a result, we intend for theour compensation programs to create a significant incentive to properly manage the Company, which in turn will create long-term benefits for the shareholders without encouraging the taking of excessive risks that could be detrimental to the growth of the Company or the interests of theour shareholders.

Our executive compensation program providesprograms provide a balanced mix of salary, incentive bonuses and equity awards. By creating a compensation program that includes both long- and short-term goals and targets, we believe that each element of the overall program, comprised of base salary, annual cash incentive plan awards, and longer-term stock options, stock appreciation rights, and performance-based restricted stock unit grants,PRSUs, complements and rewards annual performance, as well as ensurespromotes long-term viability, growth and shareholder value. Conversely, in order to reduce the risk of focusing on too narrow a result, currently no portion of an award under the compensation programs is based solely on an increase in the Company's stock price. Further, no award isAwards are not grossed-up or otherwise adjusted to account for its tax consequences, and the calculation of awards under the programs is established, except as otherwise indicated, based on U.S. GAAP financial measures consistent with our audited financial statements. Additionally, to retain and attract qualified executive and management talent, the Board has approved several retirement benefit plans.plans and certain limited perquisites.

We understandbelieve that compensation programs should be designed to reduce the opportunity for participants to take unnecessary risks to the detriment of the shareholders or the Company's future viability in order to achieve identified performance targets.viability. We have designed the Company's executive compensation programs to address these risks and minimize the opportunity for any individual to manipulate or undermine the programs. We have accomplished this by tailoring the

programs to incorporate objective features.measurable objectives. These featuresobjectives include plan and targeted objectives including revenues, operating and pre-tax profit, organic and acquisition growth, cash flow, and return on average invested capital. The objectives also include certain non-financial measures such as management succession, including identifying and cultivating future managers and executives, that are set in advance and reviewed periodically by the Board, annual bonus-based calculations,Board. Performance objectives, and goals and responsibilities set jointly by usthe Compensation Committee with input from the PEO and asCEO, are approved by the Board. The objectives include operating profit, return on invested capital, management succession planning, and profitable sales growth.Board annually. Further, the Board reviews and approves all executive bonus payments. We implemented these programs beforein part to reduce the latestopportunity for manipulation during economic turbulence and in doing so avoided the complications experienced by others during the initialdownturns or financial turmoil and extended economic stagnation. Thus, after the initial downturn and during the continued slow economic recovery, the Board determined, except as indicated in this discussion, no significant material changes were necessary to preserve the integrity of the programs.turmoil.

Role of Independent Compensation Consultants

TheTo ensure that our compensation programs continue to meet our philosophy and are responsive to economic changes, the Compensation Committee has the authority to, and we do, periodically retainretains outside consultants to assess the adequacy and fairness of the Company's compensation programs. WeThe Compensation Committee also meetmeets frequently with the PEOCEO to obtain management's recommendations on compensation issues; however, Company management personnel are not involved in approving executive compensation programs. In 2013, we instructed theThe Company to retainretained Pay Governance, an independent consulting firm, to provide an updateda review and guidance of the officer compensation structure in 2019, which had been previously reviewed and updated in 2017. The next review and analysis is scheduled to occur in 2021.

Pay Governance does not provide other services to the Company, is not dependent on the Company as a material source of revenue, has no personal or business relationships with any member of the Compensation Committee or executive officers of the Company, and does not own any Company stock. Thus, the Compensation Committee concluded that no conflict of interest exists with respect to the services provided by Pay Governance.

After considering the information provided by Pay Governance, the Compensation Committee determined that no significant changes were necessary to the Company's overall compensation structure. This study was completedThe Compensation Committee will continue to review all aspects of our executive compensation program, taking into account our commitment to align executive compensation to augment shareholder value and reviewed in 2014,positive financial results, and was updatedwill make changes as necessary to reflect pertinent market, economic and reviewed again in 2015.competitive conditions.

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 32 -

Results of 2014 COMPENSATION DISCUSSION AND ANALYSIS

Shareholder VoteAdvisory Votes on Executive Compensation

In 2014,2020, the Company's shareholders approved, on an advisory, nonbinding basis, the compensation of the NEOs by an overwhelming majority (the so called "say-on-pay" vote). Specifically, as a percentage, 96.4%93.4% of the shares voted were to approve the compensation. Given the strong level of shareholder support, the Board of Directors determined that no material changes to the Company's compensation plans were necessary as a result of the 20142020 say-on-pay vote. Nonetheless, as has been our practice, we regularly evaluate these plans and recommend changes, as we deem appropriate. The Board of Directors and the Compensation Committee value the opinions of the Company's shareholders and will continue to evaluate any concerns raised by the shareholders regarding executive compensation.

At the 2014 annual meeting,2017 Annual Meeting, the Company'sCompany’s shareholders also cast an advisory vote to review executiveNEO compensation every three years. Thus,years, and that recommendation was adopted by the Board of Directors. Both the next say-on-pay vote on the NEO compensation and the next advisory, nonbinding vote on the frequency of future say-on-pay votes willon the compensation of our NEOs are expected to occur at the 2017our 2023 Annual Meeting of Shareholders.

Although both of these shareholder votes are on an advisory, nonbinding basis, we consider the results to be a strong affirmation of the actions taken by the Board of Directors in establishing the compensation plans for the NEOs and will continue to monitor the shareholders' opinions regarding executive compensation.

| |

IV. | Executive Compensation |

Executive Compensation

Elements of Executive Compensation

The Compensation of the NEOs outlined in the Proxy Statement is a combination of realized and realizable pay. We define realized pay as compensation that is actually awarded to ana NEO, or paid on that NEO's behalf, as a result of the performance or achievement of certain goals and objectives for a given year. We define realizable pay as the potential value of future payments that may be awarded over a specific periodperiods of time in the future. The Company is required to value realizable pay, even though it is not yet available to the NEO, at a specific point in time, either at the time of grant of the potential award or as of the end of the fiscal year. Depending on a number of factors, including the long-term increase in shareholder value, these contingent future payments and contingent payment opportunities may be more or less than the value assigned to these awards in this Proxy Statement.

As one of the oldest ESOP service companies in the United States, our compensation plans are developed in part with the objective of retaining and fostering employee ownership. Thus, many aspects of our compensation plans, including the annual incentive compensation plan, as well as the granting of stock options and PRSUs, were developed to promote employee ownership through company performance and enhanced shareholder value.

| | | | | | | | |

| The Davey Tree Expert Company - 2021 Proxy Statement | | |

- 33 -

COMPENSATION DISCUSSION AND ANALYSIS

The compensation plans discussed in the Proxy Statement, as well as their category, are as follows:

| | | | | | | | |

| REALIZED PAY | | REALIZABLE PAY |

| (payment and compensation) | | (potential payments and opportunities) |

| | |

Realized Pay | | Realizable Pay |

| Base Salary | | Stock Options |

Supplemental Bonus Plan | | Stock Appreciation Rights ** |

| Annual Incentive Compensation Plan | | Qualified Retirement PlansStock Appreciation Rights * |

PerquisitesSupplemental Bonus Plan | | Nonqualified Retirement Plans |

| | Restricted Stock Units |

| | Performance-Based Restricted Stock Units |

| Perquisites | | Qualified Retirement Plan |

| | Nonqualified Retirement Plans |

* Awarded prior to 2019 and exercisable over time in future years.

Performance** Discontinued for 2021 and Pay

We believe our executive officer compensation programs are closely aligned with the interests of the Company's shareholders. Among other things, as discussed more fully in the Annual Incentive Compensation Plan caption of this Section, a significant portion of a NEOs' annual pay is comprised of the annual management incentive compensation plan calculation. The weighting toward management incentive compensation plan payments is designed to link a substantial percentage of the NEOs' pay to goal achievement and Company performance. Moreover, the long-term incentives are performance-based, reflect competitive market levels and practices, and focus executives on the longer-term financial performance and strategic development of the Company.

For 2015, the objectives included goals related to revenues, operating profit, growth, acquisitions, and management succession. With regard to these objectives, in 2015 the Company's sales were a record high and increased 4.1% over the prior year. Operating profit in 2015 was $54,177,000 and the Company achieved an operating profit percentage of 6.6%. Moreover, the Company completed multiple acquisitions and each NEO was engaged in the management succession planning both with the assistance of the Board of Directors and with other officers and managers of the Company.going forward.

Each element of the NEOs' compensation, including additional information regarding the alignment of pay and performance for each program, is discussed in more detail below.

Base Salaries

WeAlthough not tied to a specific benchmark or pre-determined formula, we pay executive officers a base salary that generally is near 90% of the market "midpoint" for similar positions at companies that areof approximately theour same size and complexity. Although weWe have not established a unique peer group for compensation competitiveness studies,studies. However, we periodically retain Pay Governance an independent compensation consulting firm, to determine the adequacy of base salaries, as well as all other compensation of the Company's executive officers. Further, even though annual base salary adjustments are not directly tied to a benchmark or other predetermined formula, we utilize Pay Governance toThis review includes examining market data as part of itsthe evaluation process. We engaged Pay Governance to review compensation in 2013, which was completed and reviewed by us2019, with the next review scheduled to occur in 2014, and again in 2015, which was completed and reviewed by us in December 2015.2021.